|

| Deduction Under Section 57 |

In our previous articles, we covered the scope of Income from Other Sources under Section 56, and the various incomes taxable under Section 56(2). This third installment focuses on how you can reduce your tax liability through allowable deductions under Section 57, what expenses are expressly disallowed under Section 58, and best practices for compliance and tax planning.

1. Deductions under Section 57

Section 57 permits deductions “wholly and exclusively” incurred for earning income from other sources. These reduce your net taxable income and include:

- Interest on Borrowed Capital

- If you borrow funds to invest in interest-bearing securities (like bonds) or dividend-paying shares/funds, the interest paid on that loan is deductible.

- Example: You take a ₹ 100,000 bank loan at 8% p.a. to buy government bonds; you can claim ₹ 8,000 as a deduction.

- Commission and Fees

- Brokerage, commission, or management fees paid to earn dividend or interest income.

- Example: A ₹ 500 brokerage fee on a mutual fund dividend reinvestment can be deducted.

- Standard Deduction on Family Pension

- A flat ₹ 15,000 or one-third of family pension (whichever is less) is allowed if you receive family pension under Section 57(ia).

- Depreciation

- For assets (like machinery) rented out under Section 56(2)(ii)/(iii), depreciation can be claimed under Section 57(iii).

- Other Direct Expenses

- Any other expenses exclusively for earning that income:

- Cost of printing lottery tickets if you organize a lottery

- Professional fees for valuing gifts or stamp-duty assessments

Key Condition: The expense must be directly linked to the income source and not personal or capital in nature.

|

| Allowed vs Disallowed Expenses under Section 58 |

2. Non-Deductible Items under Section 58

Section 58 lists expenses that cannot be claimed even if related to “other sources” income. Common disallowances include:

- Interest Not Deductible

- Interest on borrowed capital if tax has not been deducted at source or paid by the recipient

- Salaries

- Employee salaries or remuneration paid for services, unless taxed under “Profits and Gains of Business.”

- Expenses Related to Exempt Income

- Any cost incurred to earn exempt incomes, like dividends from domestic companies (subject to section V of Chapter III being exempt) or gifts from relatives.

- Wealth-Tax Paid

- Wealth-tax on assets does not reduce income from other sources.

- Any Expenses in Default of TDS Provisions

- If you fail to deduct TDS where required, the related expense is disallowed.

Tip: Maintain a separate head of accounts for exempt vs. taxable incomes to avoid inadvertently claiming disallowed items.

|

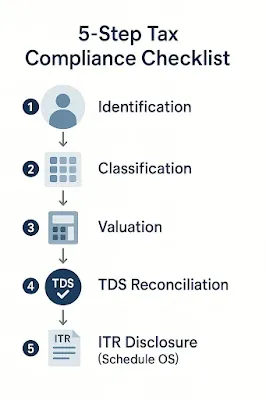

| 5-Step Tax Compliance Checklist |

3. Compliance Checklist

Accurate reporting and documentation safeguard you against notices and penalties. Follow this checklist each year:

| Step | Action |

|---|---|

| Identification | List all miscellaneous receipts (interest, dividends, gifts, etc.). |

| Classification | Map each receipt to the correct clause in Section 56(1)/(2). |

| Valuation | Use fair market/stamp-duty values for gifts and discounted transfers. |

| TDS Reconciliation | Match TDS certificates (Form 16A) with income claimed. |

| Claim Deductions | Ensure expenses meet Section 57 criteria; segregate from non-deductibles. |

| Schedule OS | Disclose each receipt and deduction in Schedule OS of your ITR. |

| Support Documents | Keep gift deeds, policy statements, brokerage bills, and loan papers. |

Remember: The onus of proof lies with you. Well-organized files simplify assessments and appeals.

|

| Tax Planning Strategies Over the Financial Year |

4. Simple Tax Planning Tips

Proactive planning can legitimately lower your tax outgo under this head:

- Timing of Receipts

- Defer or accelerate interest payouts to stay within a preferred financial year.

Structuring Loans

- Borrow at concessional rates and claim full interest under Section 57, subject to real economic purpose.

Utilize Relatives for Gifts

- Route high-value gifts through specified relatives (fully exempt) rather than non-relatives (taxable above ₹ 50,000).

Bundle Expenses

- Aggregate small professional fees or valuation charges in one financial year for a more substantial deduction.

- Advance Agreements

- Draft clear sale/purchase agreements to control recognition timing of forfeited deposits.

5. Conclusion

Understanding Sections 57 and 58 empowers you to maximize deductions and avoid disallowed claims, while a robust compliance routine keeps you audit-ready. Combined with strategic tax planning, you can ensure that Income from Other Sources does not become the most burdensome head on your tax return.

Stay tuned for the final article in this series, where we’ll cover practical case studies and frequently asked questions on Income from Other Sources!

Published on Commerce Tutors – simplifying tax concepts for students, teachers, and professionals.