Understanding “Income from Other Sources” under Section 56 of the Income-tax Act, 1961

Introduction

In the Indian Income-tax regime, not all receipts fit neatly into the five primary heads—Salaries, House Property, Business & Profession, Capital Gains, and Income from Other Sources. The last head acts as a “catch-all” for leftover incomes that aren’t taxed elsewhere. This article explains the legal framework and scope of Income from Other Sources under Section 56 of the Income-tax Act, 1961, so you can clearly identify what counts as “other income,” why it matters, and how recent changes affect you.

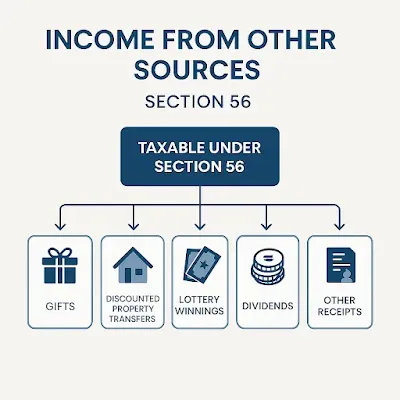

|

| Taxble Under Section 56 |

1. What Is “Income from Other Sources”?

Income from Other Sources is a residuary head of income, meaning it covers all receipts not chargeable under the other four heads. Some common examples include:

- Interest income (from savings bank accounts, fixed deposits, bonds)

- Dividend income (from shares, mutual funds)

- Gifts received (in money or property) exceeding specified thresholds

- Lottery or crossword prizes and winnings from horse races

- Rent from plant, machinery, furniture, or vehicles

- Forfeited advances or security deposits

If you receive money or benefits that don’t clearly belong to salary, business profit, house property rent, or capital gains, you’ll likely report them as Income from Other Sources.

2. Legal Framework: Section 56(1) and 56(2)

2.1 Section 56(1): The Catch-All Provision

- Section 56(1) states that any income not chargeable under the other four heads is taxable here.

- It ensures no income escapes taxation simply because it doesn’t have a specific category.

2.2 Section 56(2): Specified Receipts

- Section 56(2) lists particular receipts that must be taxed under this head, even if they might seem like other types of income.

- Key items include:

- Dividends (clause 2(i))

- Lottery, crossword puzzle winnings, race prizes (clause 2(ib))

- Interest on securities like government bonds (clause 2(id))

- Rent from machinery or plant (clause 2(ii)/(iii))

- Sum received under keyman insurance policies (clause 2(iv))

- Gifts exceeding ₹ 50,000 in a financial year (clause 2(x))

- Forfeited advances or compensation (clause 2(ix)/(xi))

- Issue of shares at a premium by a closely held company (clause 2(viib))

3. Objectives Behind Section 56

- Without this residuary head, taxpayers might try to classify unusual receipts to avoid tax.

- By explicitly including gifts, prizes, and forfeitures, the law brings non-regular receipts into the tax net.

- All taxpayers follow the same rules for miscellaneous incomes, reducing disputes over classification.

4. Historic Amendments & Recent Changes

Over the years, Section 56 has evolved to keep pace with new financial products and schemes:

- Finance Act, 2020–2021: Introduced taxation on the difference between fair market value and consideration in property transactions (anti-undervaluation rule).

- Finance Act, 2023: Clarified treatment of keyman insurance proceeds and adjusted gift thresholds for digital assets.

- Increased Gift Threshold: Gifts up to ₹ 50,000 from non-relatives are now aggregated per year before taxable; earlier, smaller gifts could trigger tax.

Staying updated on these changes is crucial, because what was exempt last year may be taxable today.

5. Why Every Taxpayer Should Care

1.Broad Coverage

- If you have multiple income streams—investments, occasional prizes, or gifts—you need to know where to report them.

2.Risk of Penalties

- Misreporting or omitting Income from Other Sources can lead to interest, penalties, and notices from the Income-tax Department.

3.Tax Planning Opportunities

- Proper classification can reduce your tax outgo. For example, timing the receipt of interest or structuring gifts through relatives (who are exempt) can save tax.

6. Key Takeaways

- Identify All Receipts: List every cash or in-kind receipt across the year.

- Classify Correctly: Use Section 56(1) for miscellaneous income and Section 56(2) for specified receipts.

- Monitor Amendments: Check annual Finance Acts and CBDT notifications for changes.

- Maintain Records: Keep gift deeds, insurance policy statements, prize certificates, and deposit agreements handy.

Conclusion

Section 56 of the Income-tax Act ensures that no income goes un-taxed simply because it doesn’t fall under the main heads. By understanding its scope, your compliance becomes straightforward and you can seize tax-saving avenues. In the next article of this series, we will explore in detail the various types of incomes under Section 56(2) and their respective tax rates and thresholds. Stay tuned!

Published on Commerce Tutors – Your trusted guide for simple, step-by-step tax insights.