.webp) |

| How a Bogus Agricultural Income Claim Cost ₹35 Lakh: A Cautionary Tale for Taxpayers |

When you file your income‑tax return, you may be tempted to claim every exemption possible. But as the recent Hyderabad Tribunal case shows, fake agricultural income claims can backfire spectacularly—leading not only to hefty tax bills but even criminal prosecution. In this post, we’ll walk through what happened, why it mattered, and exactly how you can avoid the same fate.

1. Background: Why Agricultural Income Exemption?

Under the Income‑Tax Act, agricultural income is fully exempt from tax. Many taxpayers—including businessmen and salaried employees—try to use this exemption to reduce their overall tax liability. Legitimate farmers maintain land‑records, crop‑sale bills, and bank credits to prove their claims. But when those documents are forged, the consequences can be severe.

2. The Case at a Glance

|

| The Case at a Glance |

| Detail | Facts |

|---|---|

| Taxpayer | Rahul Kumar (name changed) |

| Claimed Agricultural Income | ₹22.75 lakh per year from “sweet lime” cultivation |

| Total Claimed (5 years) | ₹1.14 crore |

| Documents Produced | Bogus land‑ownership certificate and patta book |

| Actual Reality | No cultivation; land not in taxpayer’s name |

| Tribunal Ruling | Income reclassified as “Income from Other Sources” |

| Tax, Interest & Penalties | ₹35.15 lakh |

| Legal Exposure | Possible prosecution under Sections 271(1)(c) & 277 |

3. Key Lessons Learned

|

| Penalties & Prosecution |

- Exemption Isn’t a Free Pass

- Even if the law allows an exemption, your claim must be backed by genuine, verifiable evidence.

Penalties Multiply Quickly

- Beyond the tax due on ₹1.14 crore, interest at 1% per month and penalties under Section 271(1)(c) can double or even triple your liability.

Criminal Liability Is Real

- Under Section 277, willful false statements can lead to prosecution—and potentially imprisonment.

4. Practical Checklist Before You File

|

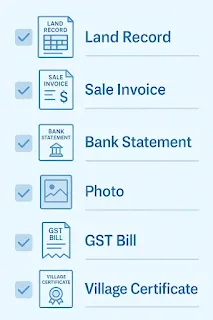

| Checklist Before You File |

Use this checklist to ensure your agricultural income claim is rock‑solid:

| Proof Required | Why It Matters |

|---|---|

| 🗂️ Original Land Records | Verifies ownership in your name |

| 🧾 Crop‑Sale Bills & Invoices | Shows actual sale of produce |

| 🏦 Bank Statements | Confirms receipt of sale proceeds |

| 📸 Field Photographs / Geo‑Tags | Supports physical existence of cultivation |

| 📄 GST / Input‑Purchase Bills | Demonstrates genuine farming inputs |

| 📋 Third‑Party Declarations | Adds credibility (e.g., local panchayat) |

5. Structuring Your Case File

When maintaining documentation, organize everything in this order:

- Title Page with taxpayer details & assessment year

- Land Ownership Proof (Registry, Patta)

- Farming Activity Evidence (Soil tests, geo‑tagged images)

- Sales Records (Crop‑sale bills, dispatch invoices)

- Bank Transactions (Credits from buyers)

- Supporting Declarations (Neighbours, local authority)

A clean, well‑indexed file makes audits smooth and reduces suspicion.

6. Conclusion: Compliance Is Your Best Protection

|

| Choose the Right Path |

Too many taxpayers view exemptions as loopholes rather than rights earned through honest effort. The Hyderabad Tribunal’s ₹35 lakh penalty reminds us that false claims bring not only financial pain but legal jeopardy. By following the practical checklist above and keeping meticulous records, you can safely claim agricultural exemptions—and sleep well come audit time.

—

Did you find this case study helpful? Share your thoughts or questions in the comments below!